In such unprecedented times, it is impossible to know for sure what to do. The markets are unpredictable, and nobody has previously lived through what the world is experiencing right now. Volatility breeds nervousness so it is little surprise some investors are considering pulling everything out or hedging their portfolio. Yet where to put it when nothing appears certain?

Looks can be deceiving. Ultimately, regardless of how and when the world fully recovers from the COVID-19 pandemic, there is one thing more certain than others. There will remain a commodity with a constantly dwindling supply yet a constantly increasing demand. “Land”

Often overlooked by investors, land-banking is a buy-and-hold technique that, when done correctly and with due diligence, is also relatively low-risk. Consider this: Instead of putting your money in a low-yield savings account or an increasingly volatile stock market, you are literally investing in a tangible fixed asset. And unlike real estate that can bring with its nasty surprises such as tenants, termites and broken toilets, undeveloped land is virtually free of overheads.

What is Land Banking?

Warren Buffet, arguably the world’s most prominent investor, will turn 90 later this year and his investments have survived booms, busts, financial crises, world wars, and now a global pandemic. One of the American’s most famous tidbits of advice is: “Only buy today something you would be happy to hold for 5-10 years if the market shut down tomorrow”.

Land Banking can be a very active component in fulfilling your wealth building goals. It is estimated that over eighty percent of the millionaires in America built their wealth through real estate.

Land Banking can be a very active component in fulfilling your wealth building goals. It is estimated that over eighty percent of the millionaires in America built their wealth through real estate.Consider this advice in terms of land-banking: you could buy an empty plot of the land tomorrow, ignore it for 5-10 years and when you return to it, its size and shape will not have changed. Yet its value almost certainly will have. As the global population continues to grow, the amount of available land is going to continue diminishing. Demand will outnumber supply and the value of your investment will rise. It is simple mathematics.

Think about the neighborhood where you grew up. Has it changed? Most likely it has expanded, pushing its city limits wider, with new residential properties, commercial units, retail parks, and industrial factories. Now imagine if you had bought some land out there before the development began. Do you think its value would have risen? Without doubt. This exact strategy has turned keen entrepreneurs around the globe into millionaires. And continues to do so.

For raw land investors who know how to competently pursue this strategy — that is by leaning on experts for knowledge and experience, completing extensive due diligence, and selecting well-placed land — land-banking is a low-risk yet extremely lucrative way to build serious wealth from real estate.

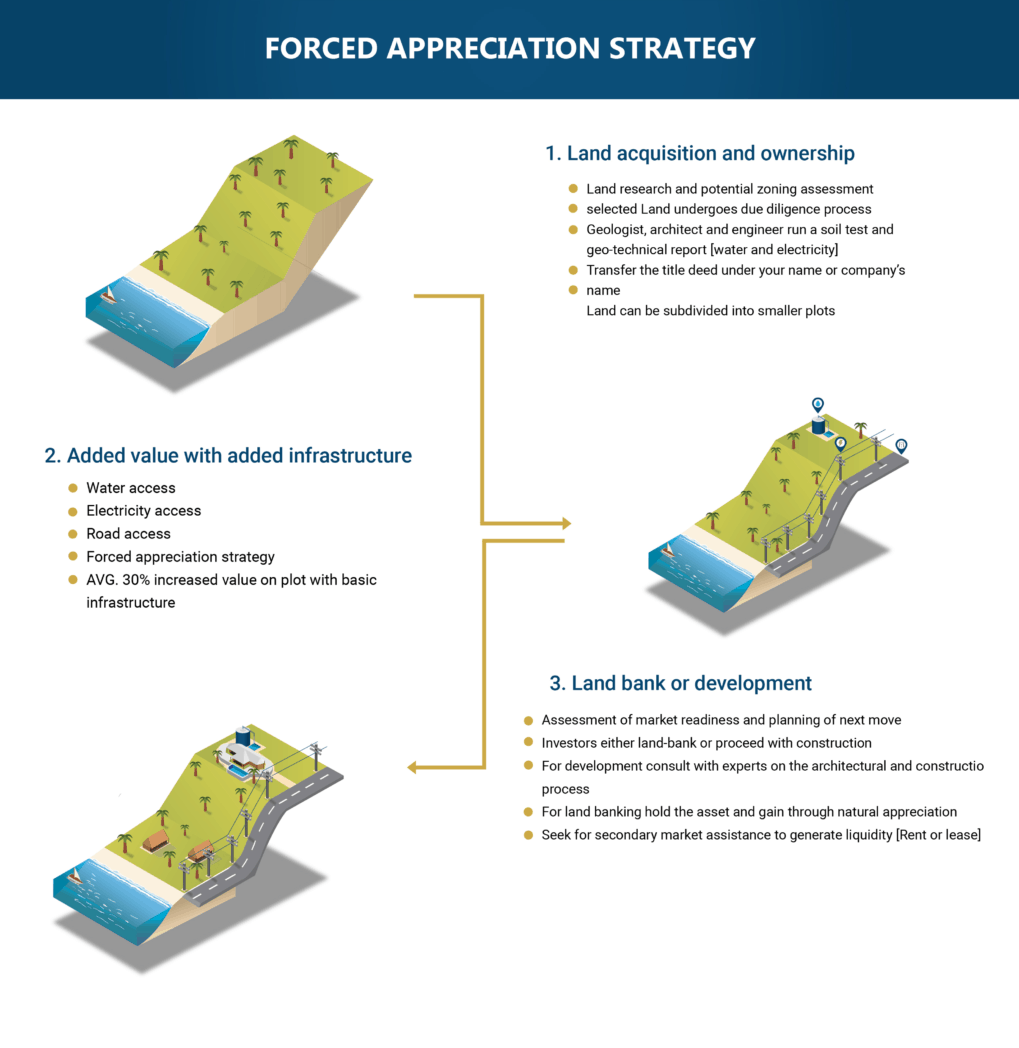

If a decade of inaction does not appeal, there are alternatives. Were you to purchase well-positioned land, apply some forced appreciation by way of installing water, electricity and road access, instantly you have an improved asset ready to sell or lease? It is a strategy both property developers and mass retailers have been doing for decades in practically every city in the world. McDonald’s, for example, may sell burgers and fries, but a massive share of the company’s revenue is generated through real estate — the rental income it receives on its 35,000-plus physical stores.

Several businesses big and small look to lease land on anything from a monthly to a yearly basis. Often these operations need undeveloped land in order to construct their physical business in a necessary way. A land lease — also known as a ground lease — allows a second party to rent a parcel of land rather than purchase it. The options do not end there: a plot of land can also be leased for other purposes, be it billboard advertising, a telephone tower, or even a cattle ranch. This method is essentially the same as leasing a property, but with the advantage of not having the overheads associated with constructing and maintaining the building and keeping your tenant’s content.

“Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world.”

– Franklin D. Roosevelt

Yet depending on the location and zoning regulations, developing property on a raw land investment can of course be an attractive option. A plot of land located in an attractive area can furnish you with both a holiday home and a buy-to-let residence. And were you to be ambitious enough to develop multi-family real estate or commercial units, multiple sources of revenue would not only potentially increase profits but also spread the associated risks.

A similar strategy is subdividing the land itself. Investors can increase the total value of their land by separating it into smaller plots and reselling them individually. It is also often easier to find various small-to-mid range investors than one large-scale investor. The subdivision process can be divided into two: mapping and legal documentation. Mapping refers to how the land should be divided and defined; legal documentation refers to the submission of the proposed subdivision, which generally includes applying to the local authorities and paying a fee. If the application is approved, the subdivision mapping is complete and recorded.

The trick for individual private investors then is to find somewhere in the early stages of development in Central America or similar or other similar areas around the world; a place where you can still purchase land at today’s rock-bottom prices before the wider world (including corporations such as major franchise hotels like Hilton, Marriott, or restaurants like McDonalds, Domino’s Pizza) perceives its potential future value. Areas in the path of growth exist in many different locations in the world and are overlooked by the majority of real estate investors, who tend to focus on property. Belize is blessed with such an opportunity, the beautiful island of Ambergris Caye, where savvy investors have realized the potential of land banking and the upside of investment.

LAND APPRECIATION CURVE

When and where you buy land is critical for the land banking concept to work as it should. Leave the science to us and trust that we are experts in acquiring pre-developed land that will be suitable for your investment goals. “Pre-developed land” is that which has been approved as part of an area master plan. Zoning for future use has been determined and approved.

One of the factors that we take into consideration when acquiring land parcels for our clients to ‘bank’ is the land appreciation curve. The idea we want to convey is the importance of buying land early in its growth phase on the land-appreciation curve. There is very little market activity with raw, undeveloped land. The capital returns on fully developed land are much lower percentage-wise. It is closely tied to the market cycles of prosperity and downturns in the local and regional economy.

WHY LAND BANK?

“Buying real estate is not only the best way, the quickest way, the safest way, but the only way to become wealthy.”

– Marshall Field

- An empty plot of land bought a decade ago will have changed neither in size nor shape, yet land is the portion of a property investment that has the potential to appreciate in value.

- Historically, the land component is often seen as a hedge against inflation.

- Often the land component of a property increases at a greater rate than the improvements that sit on top of the land.

- Improvements such as buildings can often decrease in value over time and can eventually become commercially unviable

- Often the properties with higher land value as percentage of its total worth has the potential to increase at a higher annual rate.

- Since the novel coronavirus was declared a pandemic, there has been a trend in real estate inquiries looking for safer and lower risk investments to invest capital.

HOW TO PICK YOUR LAND BANKING INVESTMENT

According to Remax100, the strategy for individual private investors is to find a location in the early stages of development – a place where you can still purchase land at relatively low prices before the wider world perceives its potential value.

- Dimensions – The size and shape of a plot could determine whether it lends itself to development.

- Topography – Is the land able to naturally accommodate services such as sewerage or will pumping be required?

- Obstacles – Is there any part of the natural landscape that would affect future development?

- Neighborhood – What properties are most prominent in the surrounding area? Is there a type of development that is likely to be more suited to what is already there?

- Population Growth – Is the property located in a potential population growth corridor?

- Tourism Growth – Is the property located in a potential tourism growth corridor?

- Zoning – Has the property the potential for improved change of use e.g. from farming to housing?

- Infrastructure – Are there plans for future highways and airports as examples?

- Near Beaches or Natural Water Ways – Located near beaches and natural environments of attraction e.g. views, beach access etc.

LAND BANKING IN BELIZE

Land mandated by Remax100 in Ambergris Caye have experienced remarkable growth in recent years. This can be attributed to several factors, including both natural appreciation and forced appreciation.

Natural appreciation is the result of an increase in tourism, zoning and the fact the land is all in prime locations. Forced appreciation, in contrast, is the result of basic infrastructure that was not previously present, such as water and electricity access, as well as paved access roads. A thorough due diligence process that secures the land titles and the encouragement from the Belizean Government and laws have positively affected lands prices.

The selection of prime locations, on the east coast provides investors an excellent advantage regardless of whether they are land-banking or constructing their own property.

The increased development by investors within certain areas of Ambergris Caye increases the organic appreciation of the area in general, cementing the likelihood of appreciation. The master plan of Remax100 has further increased the demand for land and consequently the liquidity of the market.

The east coast of Ambergris Caye is currently experiencing a sharp increase in value courtesy of the strong tourism market of Ambergris Caye the most picturesque beaches in Central America.

Meanwhile, Ambergris Caye is a quick 15 min Island hopper flight from the Belize international airport, and offers investors premium land starting at $40,000 a lot with as little as $8,000 down. This is truly an investment opportunity that will not be available for much longer.

“Don’t wait to buy real estate, buy real estate and wait.”

– T. Harv Eker

These specific land banking investments on the island of Ambergris Caye in Belize are very particular and very profitable ones, especially for experienced and new investors. These investments implement the practice of buying land and holding it for a determined period in order to re-sale the lot or develop it for a high ROI. This real estate investment in Ambergris Caye is recommended only for mid and long-term investors where owners have liquidity enough to wait until the property is ripe and ready to turn a profit. Being some of the most fastest growing properties in Belize, Ambergris Caye have very particular land opportunities to develop. Our real estate collective specializes in identifying and qualifying such opportunities in order to offer them to high-yielding investor.

IRA INVESTMENT LAND BANKING – A SUPERIOR INVESTMENT VEHICLE

Most Americans will never hear of safe yet high-performing investment vehicles such as land. Normal retirement accounts such as IRA’s composed of mutual funds and stocks that investors have little or no control over, are not performing as most people would hope. Our media is a low-risk and high-return investment. Many of our clients have rolled over their under-performing traditional IRA accounts. In a self-directed IRA account, there is more opportunity.

Banking on Land provides our clients with the same opportunities previously enjoyed by only the elite few. With the expertise and guidance of Entrust, our clients can enjoy the benefits of our extensive experience and scientific approach.

“Real estate investing, even on a very small scale, remains a tried-and-true means of building an individual’s cash flow and wealth.”

– Robert Kiyosaki

WHAT IS THE EXIT STRATEGY?

Once you have determined the time is right to sell your land bank, the exit strategy can often be one of the below three options:

- Sell all or some of the land to a developer

- Develop the land yourself to realise both the land value and developers profit

- Co-Develop with a developer partner to realise the land value and share developer’s profit.